A Business Battle for the Ages

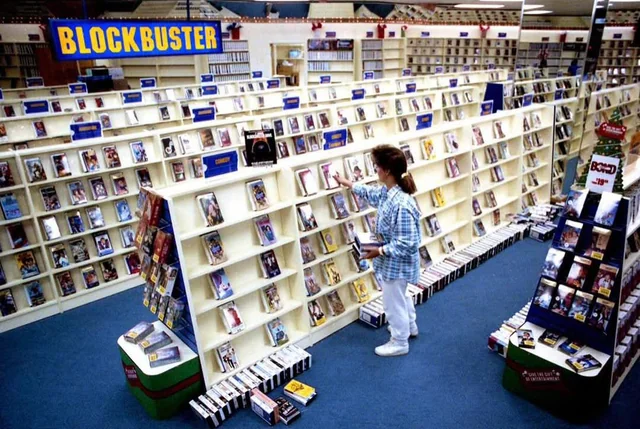

Imagine a time when going to Blockbuster on a Friday night was the highlight of the week. You’d walk into that bright blue-and-yellow store, scan rows of VHS tapes or DVDs, and feel like the king of home entertainment.

Then… almost overnight, it all vanished.

What caused this massive shift?

The answer: Netflix.

This is more than a story about two companies. It’s about:

- Why big companies fail

- How innovation disrupts tradition

- Why a $50 million rejection cost billions

- How a tech startup rewrote the rules of Hollywood

If you’ve ever rented a movie, binged a Netflix series, or asked, “Whatever happened to Blockbuster?”—this article is for you.

Blockbuster’s Golden Age – How It Rose to Power

The Birth of a Retail Giant

Blockbuster was born in Dallas, Texas, in 1985, during a time when most video rental stores were mom-and-pop shops with limited selections and clunky systems.

Its founder, David Cook, used his background in software to create a highly efficient, franchise-friendly model.

He innovated by:

- Stocking thousands of titles

- Designing bright, clean, family-friendly stores

- Using barcodes and computers for inventory tracking

This was revolutionary for its time.

Within a decade, Blockbuster grew to dominate the global market with:

- 9,000+ locations worldwide

- $6 billion in annual revenue at its peak

- High brand recall and loyalty

It became the McDonald’s of movies.

The Revenue Machine

Blockbuster wasn’t just successful—it was wildly profitable, thanks largely to one thing: late fees.

In 2000 alone, Blockbuster earned $800 million just from late returns. It was a hidden tax on customers’ forgetfulness—and it fueled Blockbuster’s empire.

But that same fee structure would later become its Achilles’ heel.

Enter Netflix – A New Kid With a Game-Changing Idea

The Birth of Netflix (From a Late Fee)

According to legend, Netflix founder Reed Hastings got the idea after being charged a $40 late fee by Blockbuster for not returning “Apollo 13” on time.

Frustrated, he teamed up with Marc Randolph to rethink how people rent movies. Instead of physical stores, they proposed:

- Renting DVDs online

- Shipping via postal mail

- No late fees

It was simple but genius.

They launched Netflix in 1997, and by 2000, it had about 300,000 subscribers—tiny compared to Blockbuster, but growing fast.

The Infamous $50 Million Offer

In 2000, Netflix approached Blockbuster and offered to sell the company for just $50 million.

Reed Hastings pitched it as a partnership:

“We’ll run your online business. You run the stores. Together, we’ll own the future of home entertainment.”

Blockbuster’s CEO, John Antioco, laughed them out of the boardroom.

At the time, Blockbuster was worth billions. Netflix? Still losing money.

But this arrogance cost them everything. Today, Netflix is worth over $200 billion. Blockbuster filed for bankruptcy in 2010.

Blockbuster’s Mistakes (And Why They Were So Fatal)

A Store-Based Model in a Digital World

As Netflix built a tech-based business, Blockbuster stayed loyal to its retail roots.

It tried to copy Netflix later with:

- Blockbuster Online

- Total Access subscription model

- In-store drop-offs for online rentals

But by then, Netflix had moved beyond DVDs and was building a streaming empire.

Internal Mismanagement

Blockbuster had major problems behind the scenes:

- Frequent CEO changes

- Tension with Viacom (its parent company)

- Debt from rapid store expansion

- No long-term digital plan

They focused too much on short-term profits, not long-term innovation.

Even when they eliminated late fees in 2005 to compete with Netflix, they lost nearly $200 million in revenue, causing investor panic.

Consumer Behavior Was Changing

Blockbuster ignored the shift in how people consumed content.

The new customer wanted:

- Instant access

- No penalties

- Convenience over ritual

Netflix gave them that.

Blockbuster was still selling in-person experiences in a world that was becoming digitally on-demand.

Netflix Becomes an Empire

From DVDs to Streaming Superpower

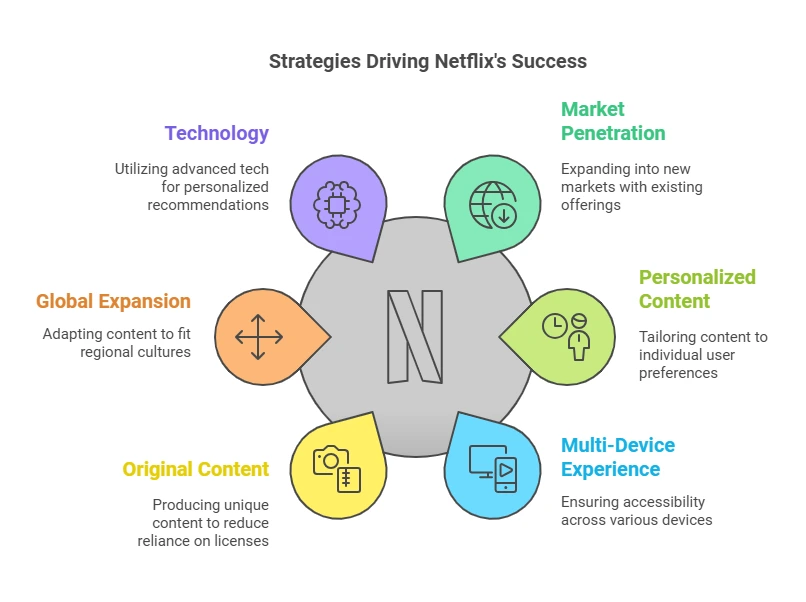

Netflix didn’t stop at disrupting DVD rentals. It evolved—and fast.

In 2007, Netflix introduced streaming. Suddenly, people could watch movies instantly—no shipping, no waiting.

By 2010, streaming became the core of their business.

By 2020, it had changed how the world consumes TV:

- Original content like House of Cards, Stranger Things, The Witcher

- Data-driven personalization through algorithms

- Multi-device access: smartphones, tablets, TVs, laptops

Netflix became more than a platform—it became a cultural habit.

Key Innovations That Drove Netflix’s Growth

| Feature | Impact |

| No late fees | Built instant loyalty |

| Subscription model | Predictable revenue |

| Personalized recommendations | Increased engagement |

| Original content | Created must-watch exclusives |

| Global expansion | Tapped into 190+ countries |

Netflix didn’t just beat Blockbuster. It redefined entertainment.

The Nostalgia of Blockbuster (And the Bend Store That Survived)

One Last Store Standing

Today, only one Blockbuster store remains, located in Bend, Oregon. It’s run independently but licensed under the Blockbuster name.

It survives thanks to:

- Tourism

- Movie lovers

- Viral marketing (helped by documentaries like The Last Blockbuster)

This store is more than a business—it’s a shrine to 1990s culture.

The 2023–2025 Viral Comeback Rumors

In 2023, Blockbuster’s dormant website was updated with cryptic messages.

Fans speculated a relaunch was coming. Blockbuster trended worldwide.

Ideas floated:

- A retro streaming app

- A subscription box service

- Merchandise drops

Nothing major has launched yet, but the interest is real—especially among millennials and Gen Z.

Could Blockbuster Make a Real Comeback?

The Power of Nostalgia in Modern Marketing

In a world of reboots (Friends Reunion, That ’90s Show), Blockbuster is perfectly positioned for a nostalgia-fueled revival.

They could:

- Launch curated movie nights with “Blockbuster boxes”

- Partner with indie theaters

- Become a retro brand like Polaroid or Atari

All they need is vision, capital, and a good CEO.

The Ultimate Business Lesson—Disrupt or Be Disrupted

This is a cautionary tale.

Blockbuster’s failure wasn’t because of Netflix.

It was because Blockbuster refused to change.

Netflix was:

- Smaller

- Less funded

- Not taken seriously

But they had one thing Blockbuster didn’t: a future-proof mindset.

Conclusion: The $50 Million That Changed the World

In 2000, Netflix begged Blockbuster for a chance.

In 2010, Blockbuster was bankrupt.

By 2025, Netflix is worth more than Disney. Its original shows are global hits. It redefined how we live, consume, and chill.

This isn’t just about one bad decision.

It’s about what happens when leaders refuse to see the future.

But ironically, the future might still include Blockbuster. Not as a store chain—but as a feeling. A brand. A memory.

And in 2025, nostalgia is big business.

FAQs – Explained in Detail

Q: Why didn’t Blockbuster buy Netflix?

A: Arrogance. In 2000, Netflix was struggling. Blockbuster thought it was a joke and didn’t understand the digital future.

Q: How did Netflix succeed where Blockbuster failed?

A: Netflix embraced change, focused on tech, removed pain points (like late fees), and evolved from DVDs to streaming to original content.

Q: What made Blockbuster’s model fail?

A: It relied too heavily on physical stores, late fees, and outdated business models.

Q: Is Blockbuster really coming back?

A: Not yet, but the viral demand and nostalgia show strong potential for a digital rebirth or branding pivot.

Q: What can startups learn from this?

A: Be agile, stay humble, and watch the trends. Disruption doesn’t knock—it kicks the door in.